Data.bitcoinity.org (Beta Version)

While BTC has stalled since reaching $9,500 final week, knowledge indicates that there’s still market demand for crypto. This indicates that Bitcoin remains in an uptrend, making $9,500 just one other pitstop earlier than higher highs. If using the ‘Aggregations’ endpoint, the common bid_volume over the time interval specified.

Markets

Bids in inexperienced on the left facet and asks in red on the right aspect, forming what appears like a valley around the market price. An order e-book is just an digital listing of buy and promote orders for an asset, organized by price stage.

Cryptocurrency Order Books

The release will allow users to freely change between quote currencies and commerce all obtainable buying and selling pairs on the BTSE trade, which means customers no longer have to select a base forex upon sign-up. Traders will also have the ability to save on buying and selling fees by side-stepping multiple transactions. The company claims the multi-forex compatibility makes it the first cryptocurrency trading platform with an order guide absolutely inclusive of crypto belongings, fiat currencies and stablecoins. We have additionally just lately seen an increase so as guide strength, which at present sits at $310 million.

Order Book Snapshots

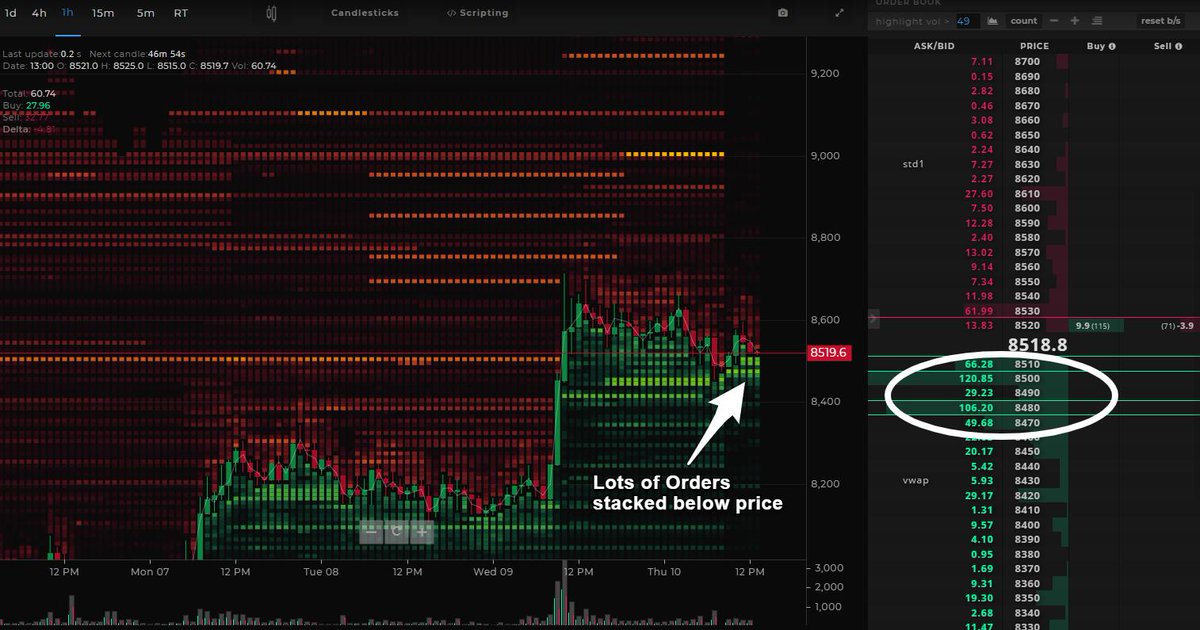

One common technique is to place a big limit order called a “wall” – known as bid partitions or ask partitions, depending on the kind of order. It is fairly frequent to see walls of ~฿1,000 at even greenback values; however large partitions of ฿5,000 can have a significant influence on market sentiment. Large restrict orders are sometimes placed to promote intention and to affect the distribution of orders across the wall (illustrated within the instance under). Traders will typically move orders forward of the wall to get executed first. The green and pink traces continue upwards, exhibiting the cumulative bids at any given worth level, reflecting the identical info because the earlier chart we looked at, but with a greater visual representation of the order guide.

L3 order e-book information is the most granular information obtainable in cryptocurrency markets, and can be used for detailed analysis or simulations of trading strategies. This data kind just isn’t for beginners, and requires an intensive understanding of cryptocurrency order books and techniques for working with large knowledge units. Each file of ticks comes with a companion file of order e-book snapshots, taken once per hour.

A bid is how much a buyer needs to pay for a specific amount of an asset, and an ask is how much a seller wants in return for a certain quantity of an asset. The amount column lets you understand how a lot of the asset is being bought or bought. Relatively new monetary information analytical service which provides real-time show of data from a number of bitcoin exchanges. As may be seen in the chart under, there is a clear purchase-facet skew on Bitcoin. The bids are indicated by the green strains under BTC and the asks are indicated by the purple strains above the value.

In other words, it is in your greatest curiosity to not signal your intention with orders within the guide. If you need to promote a big amount, you do not wish to make that large https://beaxy.com/ order visible to everyone. Instead, you’d be higher off splitting your larger order into multiple smaller orders over time, hoping to make it less apparent what you are as much as.

This will turn out to be even more handy as BTSE adds more property to the change. You can now trade any forex with another currency in one step and save time as well as trading charges. The order e-book gives a trader an excellent alternative of making extra informed decisions that are based on the purchase and sell curiosity for a particular cryptocurrency. Buy partitions affect the worth of a cryptocurrency because the price can not go decrease as a result of high demand at a higher value. The buy-side represents all open buy orders which are listed beneath the last traded value.

Although the introduction of those digital assets supplies more opportunities for buyers who’re seeking to enter the market, the poor efficiency of the platform is costing them money. Several cryptocurrency traders have identified a glitch in Binance’s order books that could possibly be affecting a handful of trading pairs.

- In the depth chart below you’ll be able to see bitcoin trading near $123.5 with bids beginning at $122.5 and asks beginning at $a hundred twenty five.

- An order e-book is a listing containing all outstanding purchase or sell orders for an asset, organized by worth level.

- Kaiko provides stage 2 order guide snapshots, aggregated by value level, for 20,000 currency pairs across eighty five+ exchanges.

- An order to buy is known as a ‘bid’ and an order to promote is known as an ‘ask’.

- The exchange’s matching engine pairs up bids and asks with market purchase/promote orders, leading to a commerce.

- The $2.5 between the highest bid and lowest ask is known as the bid-ask unfold.

So each improve in top that you just see represents a single entry within the order e-book, which means a larger improve in height means there’s a bigger quantity in an order at that worth. This shows all the open orders, bid buy orders are on the left in green and ask promote orders are on the right in pink. The x-axis under the chart exhibits the price, and the y-axis on the left and proper sides is the entire cumulative number of BTC locked up in orders. So how does the trade know how to provide the finest available price?

Market depth, bid/ask unfold, price slippage calculator, and aggregated order books averaged over time intervals (1 min.- 1day). Limit order e-book snapshots taken twice per minute, together with all bids/asks positioned inside 10% of the midprice. Liquid is perfect for traders and exchanges, and I can’t wait to see the community unfold its actual potential within the subsequent bull run. Because when the Bitcoin Network gets https://beaxy.com/faq/how-do-i-read-the-order-book/ busy, that’s the place Liquid can really shine. For one, by immediately trading your assets for the forex you want to settle in, you skip the mid-step of changing to your account’s base forex first and then from your base forex to the forex you want to purchase.

Order e-book depth can be highly risky, particularly with pairs that have inconsistent buying and selling volumes. So quite than taking a look at one snapshot, I’ve written a script to gather order book every hour, for the last week.

A “Bid” is a suggestion to buy X quantity of a particular asset at a specific price from a vendor. For a transaction to take place, a bid must be matched with an acceptable promote order. If there aren’t https://www.coinbase.com/ any sellers at the Bids’ specified price, the order will stay on the books until the price is met. The bigger the totals, the bigger the inexperienced or red colored depth to that area of the order book.

Such approaches are loosely referred to as “order execution” – trying to execute an order whereas minimizing market impression and getting the best worth. Another way to look at market and limit orders is when it comes to the knowledge they broadcast. With a limit order that goes into the e-book, you’re broadcasting your belief of what an asset is price to everyone.

These snapshots will enable the reconstruction of historic order e-book states. Bids and asks in the order book tick information may be utilized to selected snapshots within the snapshot file based mostly on the timestamp or sequence ID of the event . ✓ Study market depth across dozens of Bitcoin exchanges to identify liquid markets. ✓ Level 2 LOB snapshots, taken twice per minute, together with all bids and asks inside 10% of the midprice.

Once your order is processed by the trade, the e-book would look as follows. The buying and selling history reveals the deals which have already been made to buy or promote a cryptocurrency. Most typically, buy offers are marked in inexperienced, promote deals are marked in pink.

The last traded price is also referred to as the “bid.” It reveals the trader’s interest in a certain quantity of cryptocurrency at a sure value. Looking at the cumulative orders can improve buying and selling, as you’ll be able to see the total amount of cryptocurrency orders, in addition to their costs. Although the buy and promote sides display opposing info, the sheer idea of quantity and value are relevant to each side. The amount and value per order are displaying total items of a cryptocurrency at certain costs. added 20 cryptocurrencies to its new crypto derivatives trading platform, Binance Futures.

This is a considerable enhance for the reason that start of the yr when it was holding across the $a hundred and fifty million mark. It does this by working out the “sum of the purchase orders at 10% distance from the very best bid price”. Other indicators additionally on the up from a buying and https://www.binance.com/ selling perspective are daily spot commerce volume (now constantly above $10 billion a day) and open curiosity – which was over 500,000 BTC on the go-to high leverage exchange BitMEX. After closing the weekly candle with a doji, merchants are signalling indecision available in the market and calling for a ‘no-commerce zone’.

After merging the 2 datasets, I ran a simple linear regression with the logarithmic transformation of order guide depth on the Y-axis, and the logarithmic transformation of trading volume on the X-axis. More refined techniques embody utilizing a decay factor, which weighs bids/asks lower when they’re further away from the market price. For the needs of this text, we’re going to stay with the fundamental technique.

A lively order e-book also signifies that a cryptocurrency is less vulnerable to pump and dump schemes. On the left-hand facet you see the bids for individuals bitcoin order book buying BTC and on the proper-hand facet you see the asks for people selling it.

To understand tips on how to interpret order books, we’ve to first perceive tips on how to learn them. In the beneath, you possibly can see current trading price and quantity, in addition to the bid and asks presently in the order guide. The numbered green, purple and yellow packing containers had been added for the needs of this rationalization. Order books are important because they’re updated in actual time and point out the market health of a cryptocurrency. If a forex has a lively order book it implies that it has a high liquidity, which in turn means that the forex may be purchased and bought rapidly without it inflicting price fluctuations.

0 responses on "Btc"